north carolina estate tax return

Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Ad Download or Email IRS 706 More Fillable Forms Register and Subscribe Now.

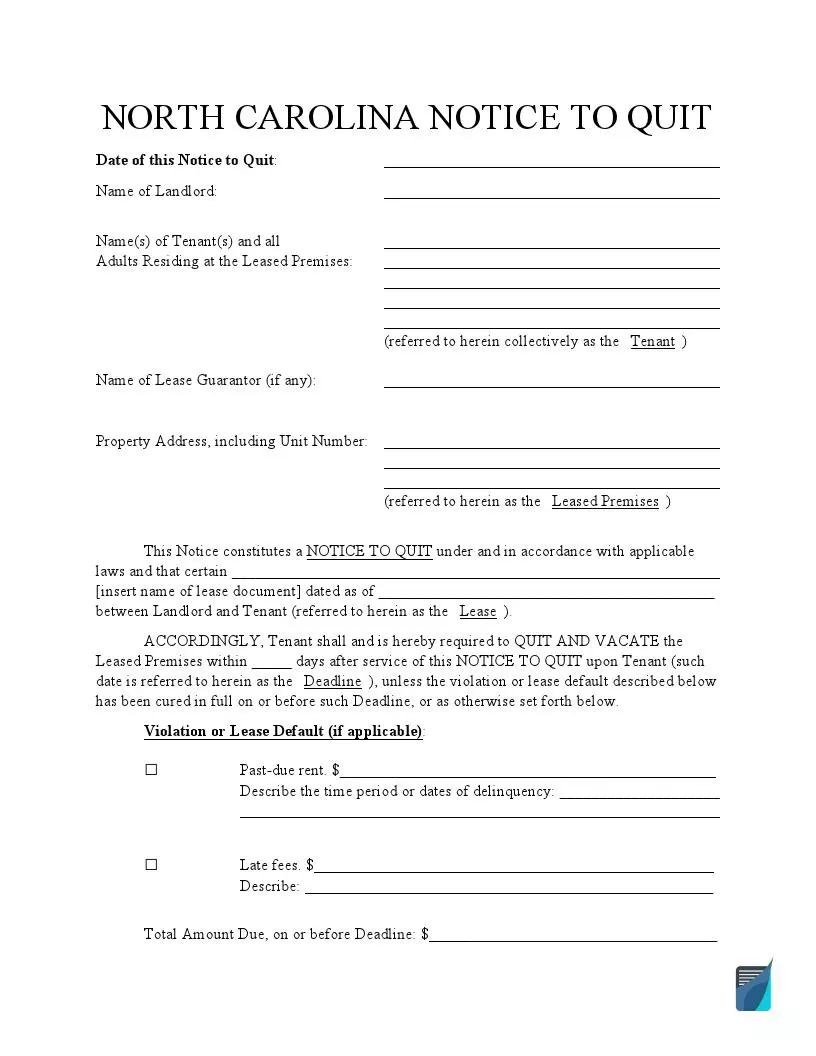

Free North Carolina Eviction Notice Forms Nc Notice To Quit Formspal

Impact of Session Law 2022-06 on North Carolina Individual and Corporate Income Tax Returns COVID-19 Updates.

. Prior to January 1 1999 North. PDF 2314 KB - November 27 2017. The decedent and their estate are separate taxable entities.

Application for Extension for Filing Estate or Trust Tax Return. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706. Get Your Maximum Refund When You E-File With TurboTax.

What Is North Carolina Estate Tax. Form D-407 is a North Carolina Corporate Income Tax form. Ad Free For Simple Tax Returns Only.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. Use this form for a decedent who died before 111999.

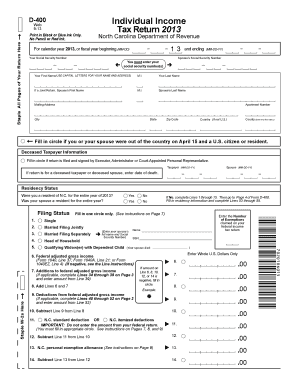

For calendar year filers the tax filing deadline this year is Thursday April 15. 2003 Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002. The information included on this website is to be used only as a guide in the preparation of a North Carolina individual income tax return.

While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules. Before filing Form 1041 you will need to obtain a tax ID number for the estate. North Carolina Estate Tax Return - 2003.

IRS Form 1041 US. North Carolina Estate Tax Return - 2002. An estates tax ID number is called an employer identification.

Owner or Beneficiarys Share of NC. Application for Extension D-410P for Filing Partnership Estate or Trust Tax Return Web 8-19 Instructions Purpose - Use Form D-410P to ask for 6 more months to file the North Carolina Partnership Income Tax Return Form D-403 or the North Carolina Estates and Trusts Income Tax Return Form D-407. An estate or trust that is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file the corresponding North Carolina income tax return.

If the return cannot be filed by the due date the fiduciary may apply for an automatic six-month extension of time to file the return. PDF 10085 KB. An estate tax certification under GS.

Department of Revenue Offers Relief in Response to COVID-19 Outbreak Notice. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. 2003 Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 This resource is related to.

Beneficiarys Share of North Carolina Income Adjustments and Credits. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal tax return for. If the decedent owned property in two or more states the credit must be prorated between those states by completing Schedule Z below.

The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. 2002 Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 This resource is related to. 28A-21-2a1 is not required for a decedent who died on or after 112013.

PDF 33315 KB - December 30 2019. North Carolina Estate Tax Return - 2006. NC K-1 Supplemental Schedule.

The increasingly popular eFile method remains the fastest and safest way to file an accurate return and receive a refund. Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2005 Form A-101 Web North Carolina Estate Tax Return For deaths. Then print and file the form.

Link is external 2021. Filing Requirement-- A North Carolina Estate Tax Return Form A-101 is required to be filed by the personal representative if a federal estate tax return Form 706 is required to be filed with the Internal Revenue Service and the decedent was domiciled in North Carolina at death or the decedent owned real property or tangible personal property located. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Estates and Trusts Fiduciary. TurboTax Is Designed To Help You Get Your Taxes Done. Complete this version using your computer to enter the required information.

Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. PDF 10085 KB. Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2005 Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 and before January 1 2005 Files.

This is the first year the NCDOR is accepting Estate.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

State Employees Credit Union Tax Refund Information

North Carolina Gift Tax All You Need To Know Smartasset

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Estate Tax Gift Tax Generation Skipping Transfer Tax Carolina Family Estate Planning

How Do You Know If A Will Is Authentic And Valid Carolina Family Estate Planning

North Carolina Income 2021 2022 Nc Forms Refund Status

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Lexisnexis Practice Guide North Carolina Estate Planning Lexisnexis Store

Nc Tax Forms Pdf Fill Online Printable Fillable Blank Pdffiller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

North Carolina Gift Tax All You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What Is A Charitable Remainder Trust Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset